40 zero coupon bonds tax

Zero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. ... state, and local income tax on the imputed or "phantom" interest that accrues each year ... › terms › zZero-Coupon Bond Definition - Investopedia May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

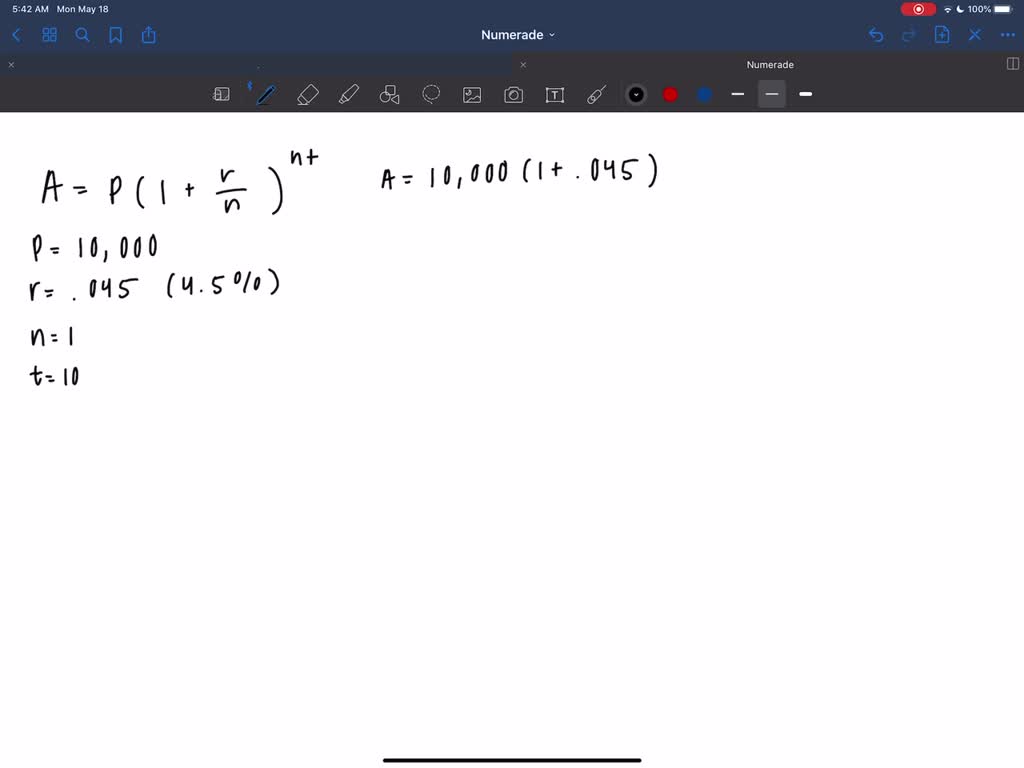

Zero-coupon bond - Wikipedia Therefore, zero coupon bonds subject to US taxation should generally be held in tax-deferred retirement accounts, to avoid taxes being paid on future income. Alternatively, when a zero coupon bond issued by a US state or local government entity is purchased, the imputed interest is free of U.S. federal taxes and, in most cases, state and local ...

Zero coupon bonds tax

en.wikipedia.org › wiki › United_States_TreasuryUnited States Treasury security - Wikipedia Series I bonds are the only ones offered as paper bonds since 2011, and those may only be purchased by using a portion of a federal income tax refund. Zero-Percent Certificate of Indebtedness. The "Certificate of Indebtedness" (C of I) is issued only through the TreasuryDirect system. It is an automatically renewed security with one-day ... Tax Treatment of Bonds and How It Differs From Stocks Feb 27, 2022 · Zero-coupon bonds have specific tax implications. These securities are sold at a deep discount and pay no annual interest. The full face value is paid at maturity, but there's a catch. The IRS computes the "implied" annual interest on the bond, and you're liable for that amount even though you don’t receive it until the bond matures. ... Zero Coupon Bond Value Calculator: Calculate Price, Yield to … Economist Gary Shilling mentioned holders of 30-year zero-coupon bonds purchased in the early 1980s outperformed the SP 500 with dividends reinvested by 500% over the subsequent 30-years as interest rates fell from around 14.6% to around 3%. I started investing in 30 Year zero coupon treasuries. Now, zero coupon bonds don't pay any interest ...

Zero coupon bonds tax. United States Treasury security - Wikipedia Treasury bills (T-bills) are zero-coupon bonds that mature in one year or less. They are bought at a discount of the par value and, instead of paying a coupon interest, are eventually redeemed at that par value to create a positive yield to maturity.. Regular weekly T-bills are commonly issued with maturity dates of 4 weeks, 8 weeks, 13 weeks, 26 weeks, and 52 weeks. › glossary › zero-coupon-bondZero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don’t mature for ten ... › articles › investingAdvantages and Risks of Zero Coupon Treasury Bonds Jan 31, 2022 · Zero-coupon U.S. Treasury bonds have a poor risk-return profile when held alone. Long-dated zero-coupon Treasury bonds are more volatile than the stock market, but they offer the lower long-run ... What Are Bonds and How Do They Work? - The Balance Jul 03, 2022 · Zero-coupon bonds: Bonds that do not pay interest during the life of the bonds. Instead, investors buy zero-coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond matures. Convertible bonds: Can be converted into a different security—typically shares of the same company's common ...

Zero-Coupon Bond Definition - Investopedia May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... en.wikipedia.org › wiki › Zero-coupon_bondZero-coupon bond - Wikipedia Therefore, zero coupon bonds subject to US taxation should generally be held in tax-deferred retirement accounts, to avoid taxes being paid on future income. Alternatively, when a zero coupon bond issued by a US state or local government entity is purchased, the imputed interest is free of U.S. federal taxes and, in most cases, state and local ... calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... Economist Gary Shilling mentioned holders of 30-year zero-coupon bonds purchased in the early 1980s outperformed the SP 500 with dividends reinvested by 500% over the subsequent 30-years as interest rates fell from around 14.6% to around 3%. I started investing in 30 Year zero coupon treasuries. Now, zero coupon bonds don't pay any interest ... › bonds-and-taxes-3141362Tax Treatment of Bonds and How It Differs From Stocks Feb 27, 2022 · Zero-coupon bonds have specific tax implications. These securities are sold at a deep discount and pay no annual interest. The full face value is paid at maturity, but there's a catch. The IRS computes the "implied" annual interest on the bond, and you're liable for that amount even though you don’t receive it until the bond matures.

Advantages and Risks of Zero Coupon Treasury Bonds Jan 31, 2022 · Zero-coupon U.S. Treasury bonds have a poor risk-return profile when held alone. Long-dated zero-coupon Treasury bonds are more volatile than the stock market, but they offer the lower long-run ... Business - Los Angeles Times Business, jobs, economics and entrepreneurship. How Does an Investor Make Money On Bonds? Aug 06, 2021 · Zero-coupon bonds issued in the U.S. retain an original issue discount (OID) for tax reasons. Zero-coupon bonds often input receipt of interest payment, or phantom income , despite the fact the ... Zero Coupon Bond Value Calculator: Calculate Price, Yield to … Economist Gary Shilling mentioned holders of 30-year zero-coupon bonds purchased in the early 1980s outperformed the SP 500 with dividends reinvested by 500% over the subsequent 30-years as interest rates fell from around 14.6% to around 3%. I started investing in 30 Year zero coupon treasuries. Now, zero coupon bonds don't pay any interest ...

Tax Treatment of Bonds and How It Differs From Stocks Feb 27, 2022 · Zero-coupon bonds have specific tax implications. These securities are sold at a deep discount and pay no annual interest. The full face value is paid at maturity, but there's a catch. The IRS computes the "implied" annual interest on the bond, and you're liable for that amount even though you don’t receive it until the bond matures. ...

en.wikipedia.org › wiki › United_States_TreasuryUnited States Treasury security - Wikipedia Series I bonds are the only ones offered as paper bonds since 2011, and those may only be purchased by using a portion of a federal income tax refund. Zero-Percent Certificate of Indebtedness. The "Certificate of Indebtedness" (C of I) is issued only through the TreasuryDirect system. It is an automatically renewed security with one-day ...

Post a Comment for "40 zero coupon bonds tax"