42 coupon interest rate definition

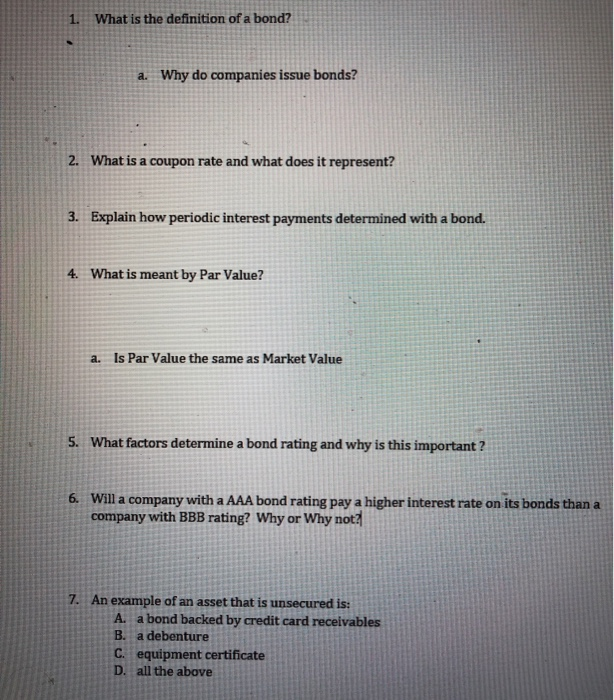

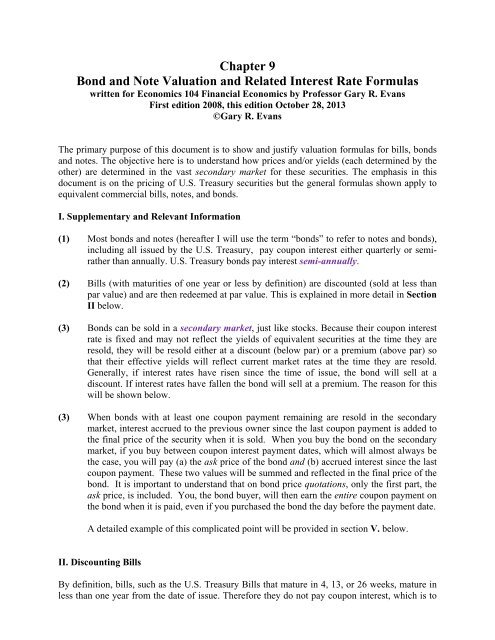

Spot Interest Rate: Meaning, Usage, Calculation, Examples The spot interest rate is the YTM or yield-to-maturity of such zero-coupon bonds. Therefore, in simple words, it is the rate of return that an investor can earn on bonds when he trades them at a particular point of time without collecting interest on them. Coupon Interest | Insurance Glossary Definition | IRMI.com Coupon Interest — the rate of interest paid to the holders of a bond. This rate can be either a floating variable or fixed rate. Often, zero coupon bonds are issued that pay no interest until the bond is redeemed to guarantee repayment of the principal of the bond or specific tranche.

What Is Coupon Rate and How Do You Calculate It? - SmartAsset The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate. In our example above, the $1,000 pays a 10% interest rate. Investors use the phrase "coupon rate" for two reasons.

Coupon interest rate definition

Coupon Rate Definition & Example | InvestingAnswers In the finance world, the coupon rate is the annual interest paid on the face value of a bond. It is expressed as a percentage. How Does a Coupon Rate Work? The term 'coupon rate' comes from the small detachable coupons attached to bearer bond certificates. The coupons entitled the holder to interest payments from the borrower. What is a Coupon Payment? - Definition | Meaning | Example Definition: A coupon payment is the annual interest payment paid to a bondholder by the bond issuer until the debt instrument matures. In other words, there payments are the periodic payments of interest to the bondholders. Coupon Rate Formula & Calculation | Coupon Rate vs. Interest Rate ... Coupon rate refers to the fixed interest payments paid by the bond issuer and will be the same during the life of the bond. On the other hand, market interest rates might rise or fall and impact...

Coupon interest rate definition. What is a Coupon Rate? - Definition | Meaning | Example Definition: Coupon rate is the stated interest rate on a fixed income security like a bond. In other words, it's the rate of interest that bondholders receive from their investment. It's based on the yield as of the day the bond is issued. What Does Coupon Rate Mean? Coupon Interest Rate: What is Coupon Interest Rate? Fixed Income ... What is Coupon Interest Rate? The Interest to be annually paid by the issuer of a bond as a percent of per value, which is specifi Coupon Rate Calculator | Solution Step by Step 🥇 The coupon rate is the yield that a bond pays annually. The coupon rate is calculated as the sum of all periodic interest payments made on a bond divided by the face value of that bond. The coupon rate will typically be lower than the stated interest rate, which is also referred to as a nominal interest rate or nominal yield. Coupon rate financial definition of Coupon rate - TheFreeDictionary.com Coupon rate. The coupon rate is the interest rate that the issuer of a bond or other debt security promises to pay during the term of a loan. For example, a bond that is paying 6% annual interest has a coupon rate of 6%. The term is derived from the practice, now discontinued, of issuing bonds with detachable coupons. ...

Coupon Definition & Meaning - Merriam-Webster The meaning of COUPON is a statement of due interest to be cut from a bearer bond when payable and presented for payment; also : the interest rate of a coupon. How to use coupon in a sentence. Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo Coupon Rate is referred to the stated rate of interest on fixed income securities such as bonds. In other words, it is the rate of interest that the bond issuers pay to the bondholders for their investment. It is the periodic rate of interest paid on the bond's face value to its purchasers. Coupon Payment | Definition, Formula, Calculator & Example A coupon payment is the amount of interest which a bond issuer pays to a bondholder at each payment date.. Bond indenture governs the manner in which coupon payments are calculated. Bonds may have fixed coupon payments, variable coupon payments, deferred coupon payments and accelerated coupon payments.. In fixed-coupon payments, the coupon rate is fixed and stays the same throughout the life ... Difference Between Coupon Rate and Interest Rate Coupon Rate is the yield that is being paid off for a fixed income security like bonds. This rate usually represents as an annual payment paid by the issuing party considering the face value or principal of the security. Issuer is the one who decides this rate.

Coupon Rate vs Interest Rate | Top 8 Best Differences ... - WallStreetMojo a coupon rate refers to the rate which is calculated on face value of the bond i.e., it is yield on the fixed income security that is largely impacted by the government set interest rates and it is usually decided by the issuer of the bonds whereas interest rate refers to the rate which is charged to borrower by lender, decided by the lender and … Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. What is Coupon Rate? Definition of Coupon Rate, Coupon Rate Meaning ... Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value. For example, if you have a 10-year- Rs 2,000 bond with a coupon rate of 10 ... Coupon interest rate financial definition of coupon interest rate coupon interest rate the INTEREST RATE payable on the face value of a BOND. For example, a £100 bond with a 5% coupon rate of interest would generate a nominal return of £5 per year. See EFFECTIVE INTEREST RATE. Collins Dictionary of Economics, 4th ed. © C. Pass, B. Lowes, L. Davies 2005 Want to thank TFD for its existence?

Learn About Coupon Interest Rates | Chegg.com The coupon interest rate often fluctuates when the value of the bond changes. The coupon interest rate is calculated by dividing the aggregate coupon payments made within a year by the par value of the securities. Investors look for securities that have higher coupon interest rates than lower coupon interest rates.

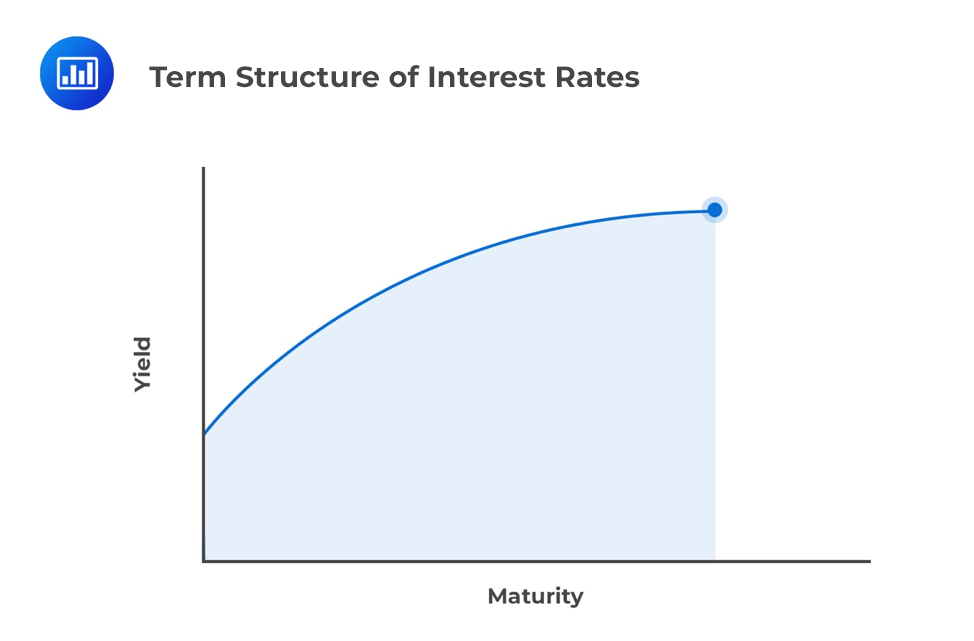

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

Difference Between Coupon Rate and Required Return Coupon Rate: Required Return: Definition: The coupon rate is the amount of interest that the buyer of the bond will receive annually. The required return is the percentage of return of bond assuming that the asset is withheld by the investor until the bond matures. Formula Coupon rate = ( Total annual payment/par value of bond) * 100

Coupon Rate: Definition, Formula & Calculation - Study.com Coupon rate, as used in fixed-income investing, refers to the annualized interest with respect to the initial loan amount. Learn the definition of and formula for coupon rate, and understand the ...

Difference Between Coupon Rate and Interest Rate The coupon rate is also known as the nominal rate. It is defined by the fixed interest secrets of the bondholder. The final amount will be received by the holder at the end of the maturity period. Additionally, the coupon rate will be stable till the bondholder receives his money. Readers who read this also read:

Coupon Rate Formula & Calculation | Coupon Rate vs. Interest Rate ... Coupon rate refers to the fixed interest payments paid by the bond issuer and will be the same during the life of the bond. On the other hand, market interest rates might rise or fall and impact...

What is a Coupon Payment? - Definition | Meaning | Example Definition: A coupon payment is the annual interest payment paid to a bondholder by the bond issuer until the debt instrument matures. In other words, there payments are the periodic payments of interest to the bondholders.

Coupon Rate Definition & Example | InvestingAnswers In the finance world, the coupon rate is the annual interest paid on the face value of a bond. It is expressed as a percentage. How Does a Coupon Rate Work? The term 'coupon rate' comes from the small detachable coupons attached to bearer bond certificates. The coupons entitled the holder to interest payments from the borrower.

.png)

Post a Comment for "42 coupon interest rate definition"