44 perpetual zero coupon bond

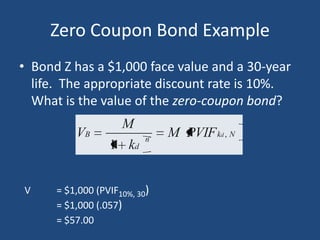

en.wikipedia.org › wiki › Zero-coupon_bondZero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond. When the bond reaches maturity, its investor receives its par (or face) value. en.wikipedia.org › wiki › Yield_to_maturityYield to maturity - Wikipedia Then continuing by trial and error, a bond gain of 5.53 divided by a bond price of 99.47 produces a yield to maturity of 5.56%. Also, the bond gain and the bond price add up to 105. Finally, a one-year zero-coupon bond of $105 and with a yield to maturity of 5.56%, calculates at a price of 105 / 1.0556^1 or 99.47. Coupon-bearing Bonds

coursehelponline.comCourse Help Online - Have your academic paper written by a ... 100% money-back guarantee. With our money back guarantee, our customers have the right to request and get a refund at any stage of their order in case something goes wrong.

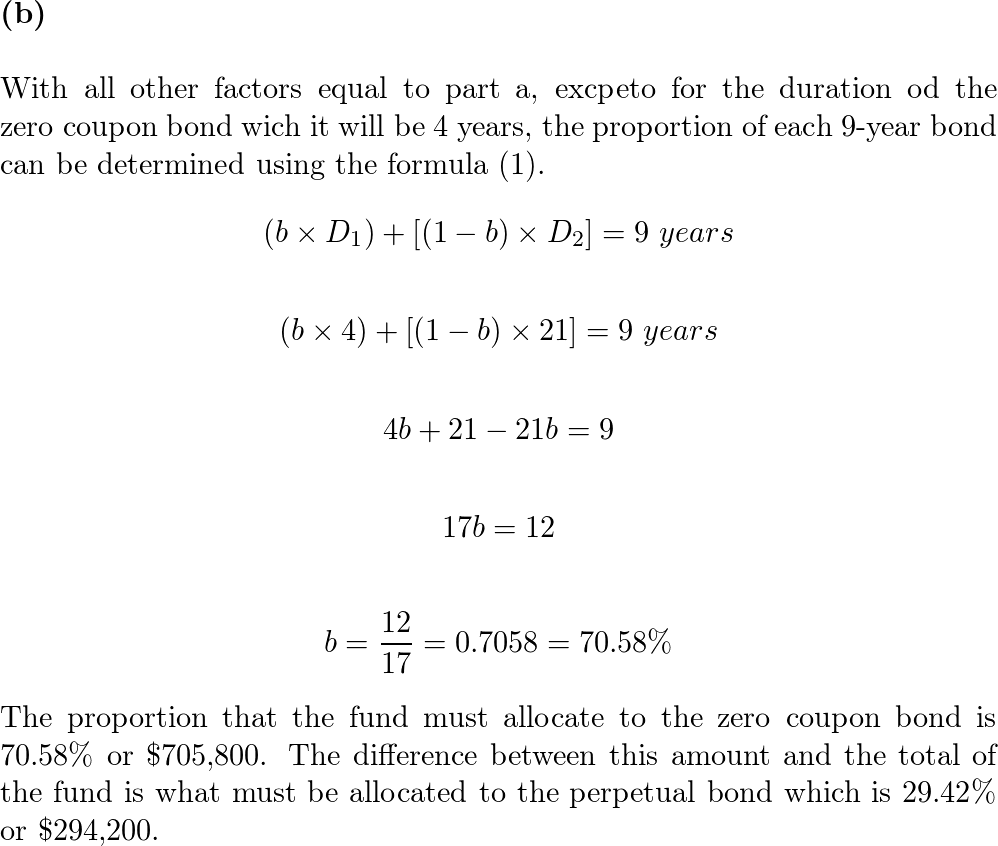

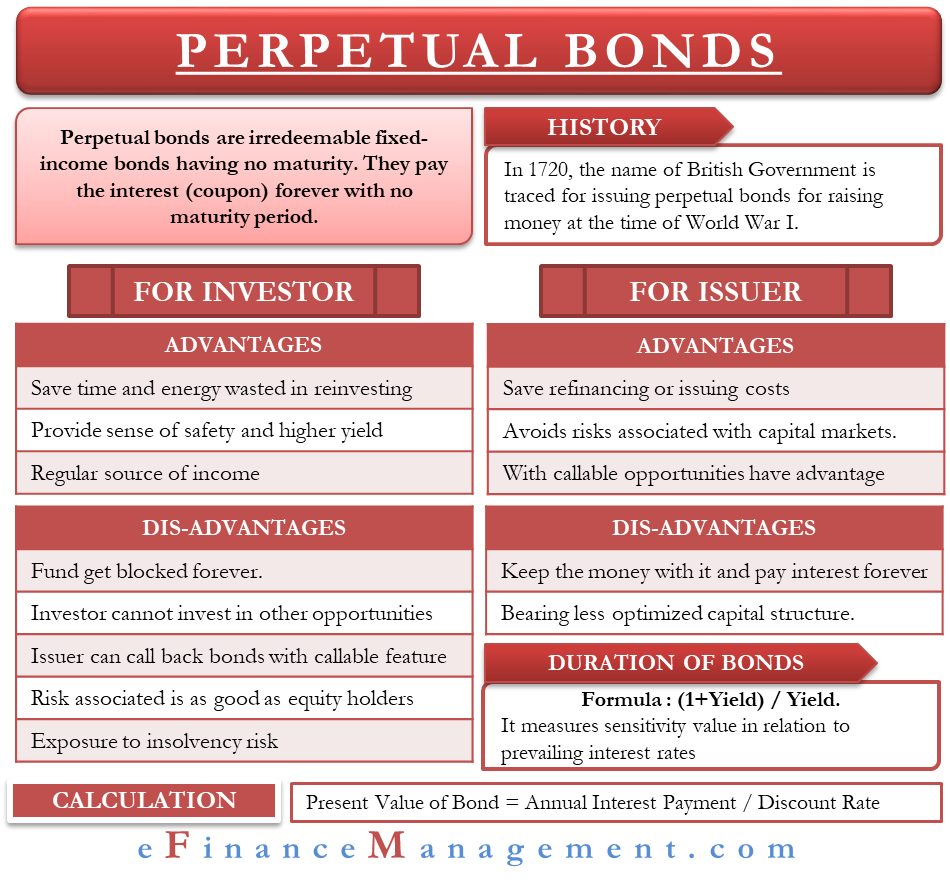

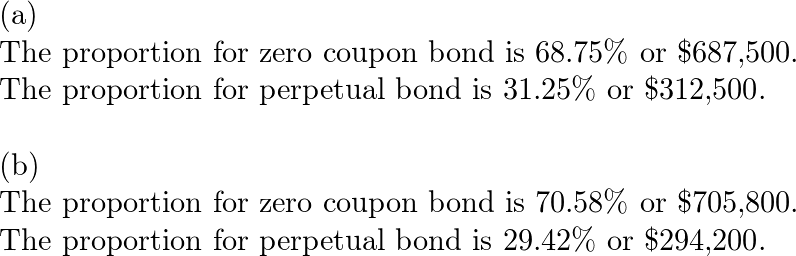

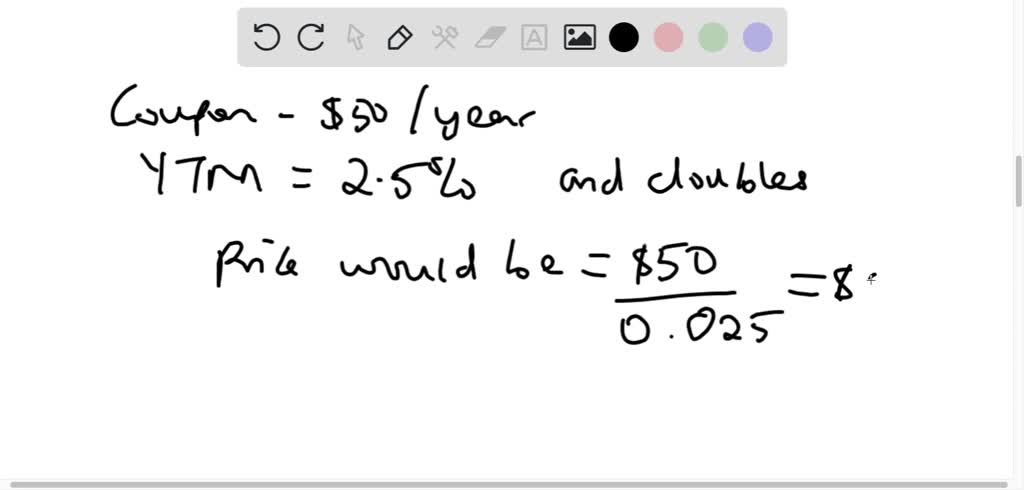

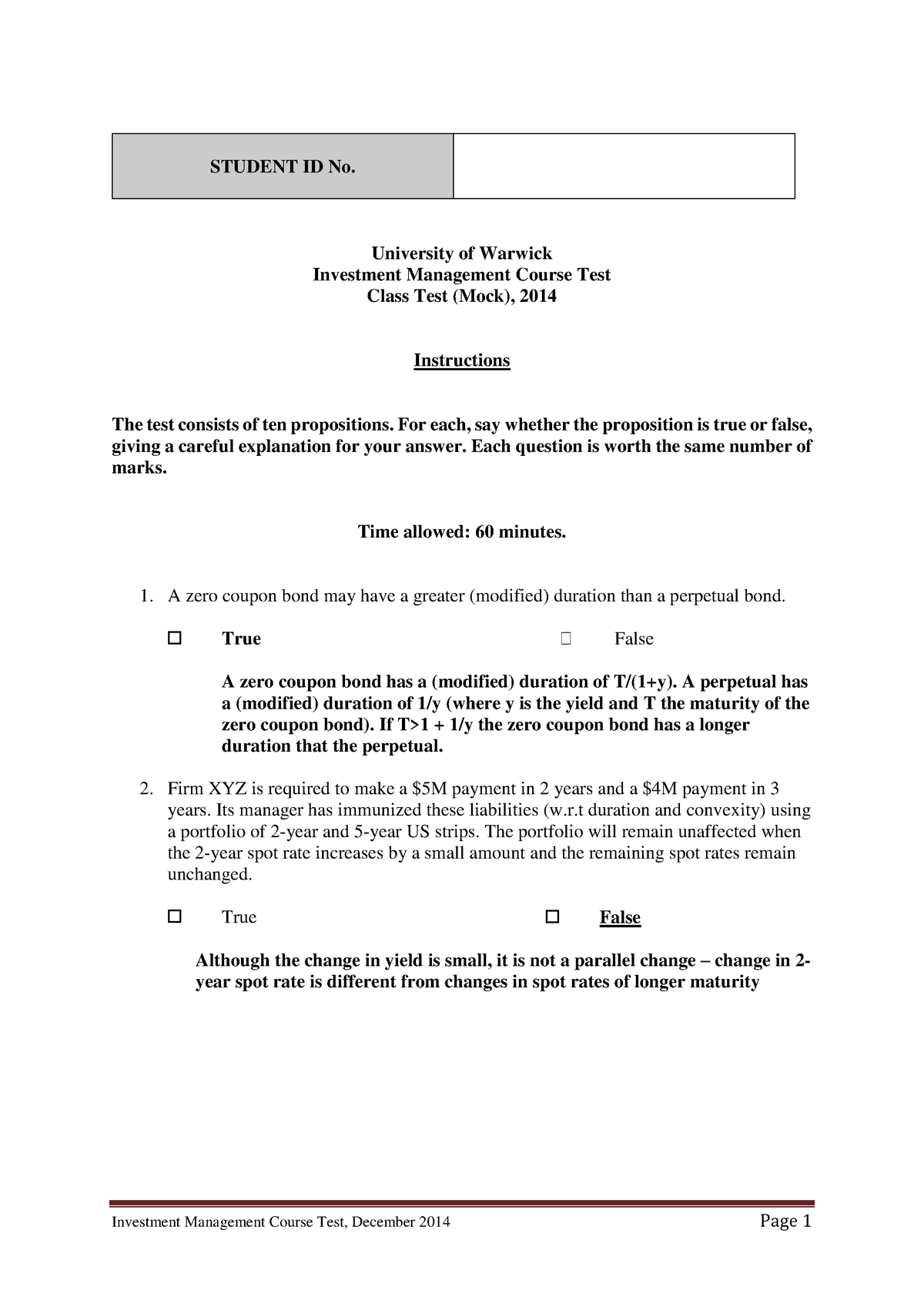

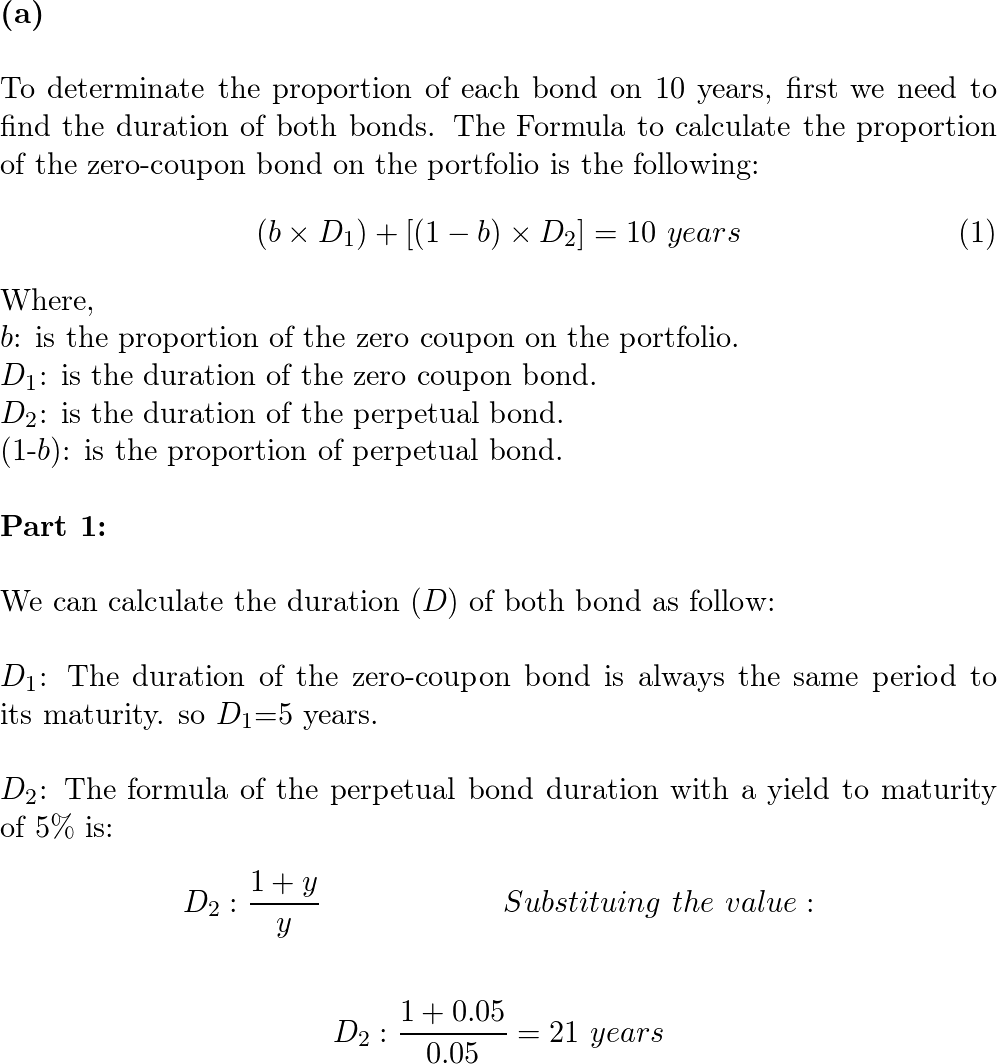

Perpetual zero coupon bond

› createJoin LiveJournal Password requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols; en.wikipedia.org › wiki › Bond_marketBond market - Wikipedia Bond trading prices and volumes are reported on Financial Industry Regulatory Authority's (FINRA) Trade Reporting and Compliance Engine, or TRACE. An important part of the bond market is the government bond market, because of its size and liquidity. Government bonds are often used to compare other bonds to measure credit risk. en.wikipedia.org › wiki › Warrant_(finance)Warrant (finance) - Wikipedia Inflation-indexed bond; Perpetual bond; Zero-coupon bond; ... Warrants are issued in this way as a "sweetener" to make the bond issue more attractive and to reduce ...

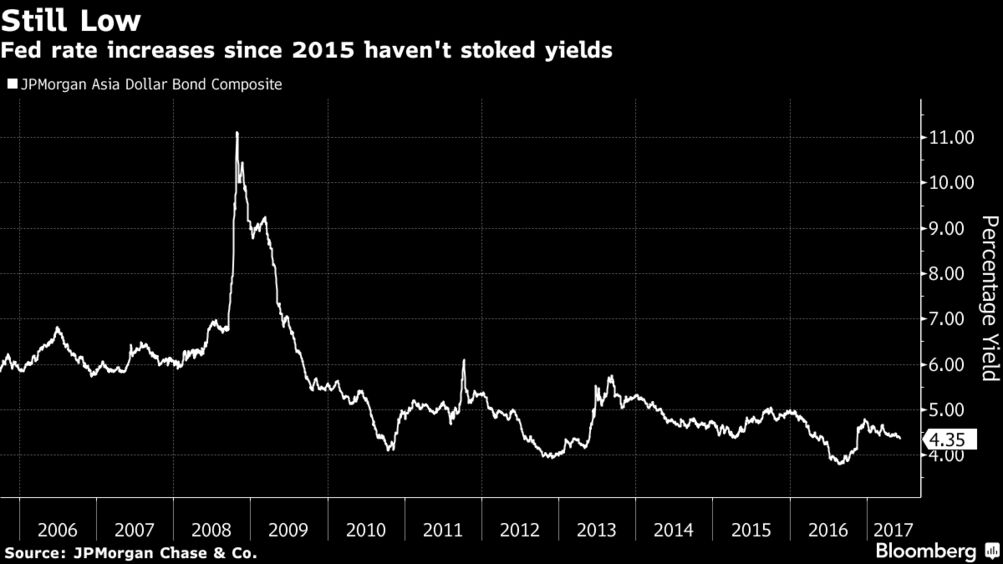

Perpetual zero coupon bond. en.wikipedia.org › wiki › Bond_durationBond duration - Wikipedia The zero-coupon bond will have the highest sensitivity, changing at a rate of 9.76% per 100bp change in yield. This means that if yields go up from 5% to 5.01% (a rise of 1bp) the price should fall by roughly 0.0976% or a change in price from $61.0271 per $100 notional to roughly $60.968. en.wikipedia.org › wiki › Warrant_(finance)Warrant (finance) - Wikipedia Inflation-indexed bond; Perpetual bond; Zero-coupon bond; ... Warrants are issued in this way as a "sweetener" to make the bond issue more attractive and to reduce ... en.wikipedia.org › wiki › Bond_marketBond market - Wikipedia Bond trading prices and volumes are reported on Financial Industry Regulatory Authority's (FINRA) Trade Reporting and Compliance Engine, or TRACE. An important part of the bond market is the government bond market, because of its size and liquidity. Government bonds are often used to compare other bonds to measure credit risk. › createJoin LiveJournal Password requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols;

Post a Comment for "44 perpetual zero coupon bond"