39 zero coupon bond value

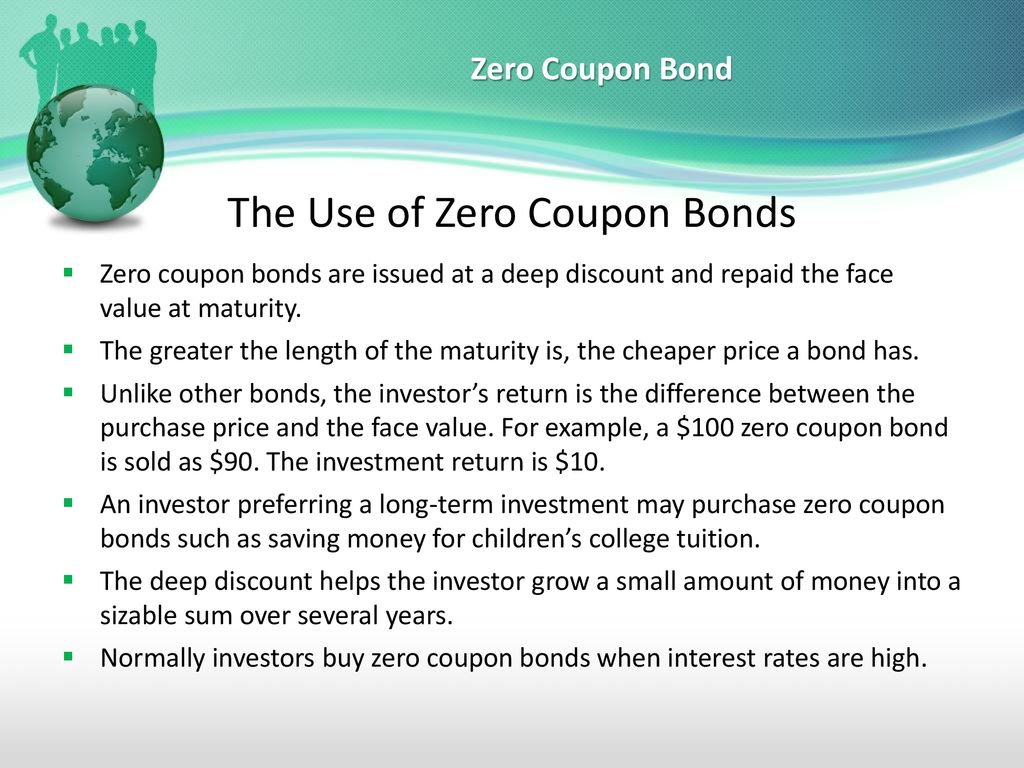

Zero Coupon Bond Value - Formula (with Calculator) - finance … A zero coupon bond, sometimes referred to as a pure discount bond or simply discount bond, is a bond that does not pay coupon payments and instead pays one lump sum at maturity. The … Zero Coupon Bond - (Definition, Formula, Examples, … Zero-Coupon Bond (Also known as Pure Discount Bond or Accrual Bond) refers to those bonds which are issued at a discount to its par value and makes no periodic interest payment, unlike …

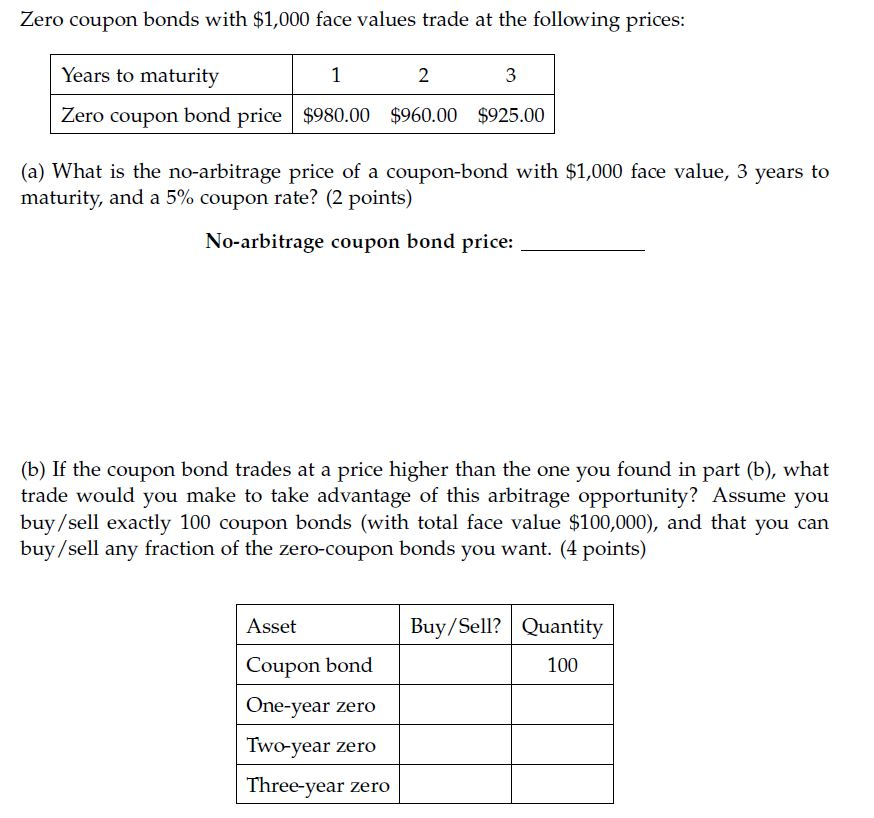

How to Calculate a Zero Coupon Bond Price - Double … 16.07.2019 · The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 …

Zero coupon bond value

Zero-Coupon Bond: Definition, How It Works, and How … What is the difference between a zero-coupon bond and … 31.08.2020 · Long-term zero-coupon bond investors gain the difference between the price they pay for the bond and the amount they receive at the bond's maturity. This amount can be … Zero-Coupon Bond Value | Formula, Example, Analysis, Calculator 24.03.2021 · The value of a zero-coupon bond is determined by its face value, maturity date, and the prevailing interest rate. The formula to calculate the value of a zero-coupon bond is. Price = …

Zero coupon bond value. Zero Coupon Bond Value Calculator: Calculate Price, Yield … Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. Divide the $1,000 by $500 gives us 2. Raise 2 to the 1/30th power and you get 1.02329. … Zero Coupon Bond Calculator – What is the Market Value? A zero coupon bond is a bond which doesn't pay any periodic payments. Instead it has only a face value (value at maturity) and a present value (current value). The entire face value of … Zero-Coupon Bond - Definition, How It Works, Formula Zero-Coupon Bonds: Characteristics and Examples - Wall … Zero-Coupon Bond Price Formula. To calculate the price of a zero-coupon bond – i.e. the present value (PV) – the first step is to find the bond’s future value (FV), which is most often $1,000. …

Zero-Coupon Bond Value | Formula, Example, Analysis, Calculator 24.03.2021 · The value of a zero-coupon bond is determined by its face value, maturity date, and the prevailing interest rate. The formula to calculate the value of a zero-coupon bond is. Price = … What is the difference between a zero-coupon bond and … 31.08.2020 · Long-term zero-coupon bond investors gain the difference between the price they pay for the bond and the amount they receive at the bond's maturity. This amount can be … Zero-Coupon Bond: Definition, How It Works, and How …

/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

Post a Comment for "39 zero coupon bond value"