39 t bill coupon rate

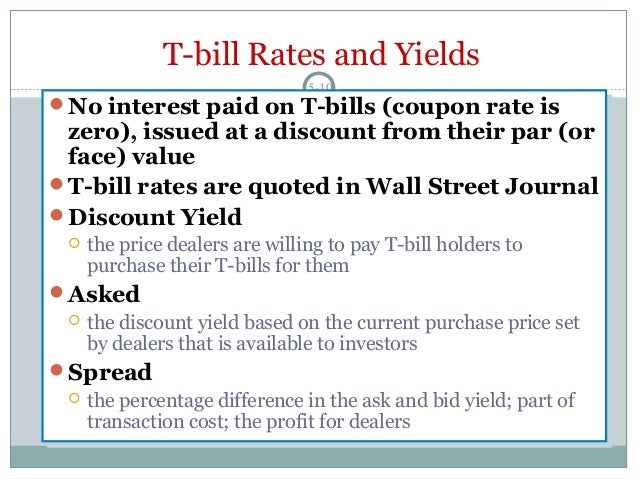

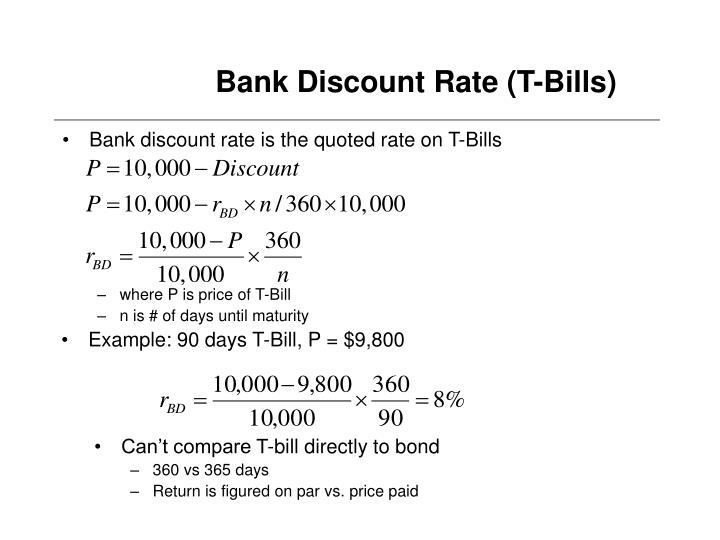

India Treasury Bills (over 31 days) | Moody's Analytics Treasury bills are zero coupon securities and pay no interest. They are issued at a discount and redeemed at the face value at maturity. For example, a 91 day Treasury bill of Rs.100/- (face value) may be issued at say Rs. 98.20, that is, at a discount of say, Rs.1.80 and would be redeemed at the face value of Rs.100/-. How To Read A T-Bill Quote - Investopedia 3*100/360=$0.83 $10,000-$0.83=$9,999.17 In this example, the seller is willing to accept $9,999.17 for a bill that will be redeemed for $10,000 in 100 days. Change The change shows the difference...

Your Money: How rate of return on T-Bills is calculated The discount is (100 x 0.06 x 108 ÷ 360) = 1.80. Thus, the price will be quoted as Rs 100 - Rs 1.80 = Rs 98.20. The quoted rate is called the discount rate. In the case of other securities, the ...

T bill coupon rate

Treasury Bills - Guide to Understanding How T-Bills Work The difference between the face value of the T-bill and the amount that an investor pays is called the discount rate, which is calculated as a percentage. In this case, the discount rate is 5% of the face value. Get T-Bill rates directly from the US Treasury website. How to Purchase Treasury Bills US Treasury Bonds - Fidelity The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity. Treasury Yield Definition - Investopedia The yield on a 10-year note with 3% coupon purchased at a premium for $10,300 and held to maturity is: Treasury Yield = [$300 + ( ($10,000 - $10,300) / 10)] ÷ [ ($10,000 + $10,300) / 2] = $270 /...

T bill coupon rate. Understanding Treasury Bond Interest Rates | Bankrate Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 in face value (par value) that you own. The ... Individual - Treasury Bonds: Rates & Terms Premium (price above par) 30-year bond reopening. Issue Date: 9/15/2005. 3.99%. 4.25%. 104.511963. Above par price required to equate to 3.99% yield. Sometimes when you buy a bond, you are charged accrued interest, which is the interest the security earned in the current semiannual interest period before you took possession of the security. US Treasury Bill Calculator [ T-Bill Calculator ] The annual percentage profit rate based the period of the treasury bill investment The annual interest rate of your T-Bill is calculated for information only. For example, you buy a $5000 T-Bill for $4800 over three months. Your profit is $200, the rate of return is 4.17% Calculations can be saved to a table by clicking the "Add to table" button TBILLPRICE Function - Formula, Examples, How to Use in Excel The TBILLPRICE Function [1] is categorized under Excel FINANCIAL functions. The function will calculate the fair market value of a Treasury bill / bond. In financial analysis, TBILLPRICE can be useful in determining the value of a bond and deciding if an investment should be made or not. It helps calculate the FMV of a Treasury bill when we are ...

The 5 Best T Bill ETFs (Treasury Bills) To Park Cash in 2022 The average rate of inflation over that period was 3.02%, which means a real return (return adjusted for inflation) of 0.3%. T Bills are sold at a discount and don't pay a coupon like most bonds, so they simply return their face value at maturity. The difference between your purchase price and that face value is your "interest." The Basics of the T-Bill - Investopedia There are auctions featuring different maturities every week except the 52-week T-Bill, which is sold every four weeks. 2 For example, a T-Bill with a maturity of 26 weeks might be sold every week... Treasury Bills (T-Bills) Definition - Investopedia A Treasury Bill (T-Bill) is a short-term U.S. government debt obligation backed by the Treasury Department with a maturity of one year or less. Treasury bills are usually sold in denominationsof... 91 Day T Bill Treasury Rate - Bankrate 91 Day T Bill Treasury Rate 91-day T-bill auction avg disc rate What it means: The U.S. government issues short-term debt at a discount at a competitive auction, usually on a weekly basis. At a...

Interest Rates: T-bill - 3 months - economy.com Interest Rates: T-bill - 3 months - Secondary market; discount basis for United States from U.S. Board of Governors of the Federal Reserve System (FRB) for the H.15 Selected Interest Rates [D, W, M] release. This page provides forecast and historical data, charts, statistics, news and updates for United States Interest Rates: T-bill - 3 months - Secondary market; discount basis. Individual - Treasury Notes: Rates & Terms 3.99%. 4.25%. 102.106357. Above par price required to equate to 3.99% yield. Sometimes when you buy a Note, you are charged accrued interest, which is the interest the security earned in the current interest period before you took possession of the security. If you are charged accrued interest, we pay it back to you as part of your next ... How Are Treasury Bill Interest Rates Determined? - Investopedia For example, suppose an investor purchases a 52-week T-bill with a face value of $1,000. The investor paid $975 upfront. The discount spread is $25. After the investor receives the $1,000 at the... TMUBMUSD01Y | U.S. 1 Year Treasury Bill Overview | MarketWatch Open 2.220% Day Range 2.125 - 2.225 52 Week Range -0.376 - 2.225 Price 2 4/32 Change -1/32 Change Percent -0.82% Coupon Rate 0.000% Maturity May 18, 2023 Performance Change in Basis Points Yield...

United States Rates & Bonds - Bloomberg Find information on government bonds yields, muni bonds and interest rates in the USA. Skip to content. Markets ... Coupon Price Yield 1 Month 1 Year Time (EDT) GTII5:GOV . 5 Year . 0.13: 100.73- ...

Selected Treasury Bill Yields - Bank of Canada Treasury bills. Treasury bill yields presented are an average of sample secondary market yields taken throughout the business day. Data available as: CSV, JSON and XML. Series. 2022‑05‑11. 2022‑05‑18. 2022‑05‑25. 2022‑06‑01. 2022‑06‑08.

Interest Rate Statistics | U.S. Department of the Treasury Daily Treasury Bill Rates These rates are indicative closing market bid quotations on the most recently auctioned Treasury Bills in the over-the-counter market as obtained by the Federal Reserve Bank of New York at approximately 3:30 PM each business day. View the Daily Treasury Bill Rates Daily Treasury Long-Term Rates and Extrapolation Factors

Individual - Treasury Bills: Rates & Terms Treasury Bills: Rates & Terms. Treasury bills are offered in multiples of $100 and in terms ranging from a few days to 52 weeks. Price and Interest. Bills are typically sold at a discount from the par amount (par amount is also called face value). The price of a bill is determined at auction. Using a single $100 investment as an example, a $100 ...

Should You Buy Treasuries? For example, assume you buy a one-year T-bill with a $1 million par value and a 2% yield to maturity. When the bill matures, your total dollar return is roughly $20,000.

Individual - Treasury Bills In Depth Treasury bills, or T-bills, are typically issued at a discount from the par amount (also called face value). For example, if you buy a $1,000 bill at a price per $100 of $99.986111, then you would pay $999.86 ($1,000 x .99986111 = $999.86111).* When the bill matures, you would be paid its face value, $1,000.

Treasury Bill (T-bill) Definition & Example | InvestingAnswers A Treasury Bill, or T-bill, is short-term debt issued and backed by the full faith and credit of the United States government. These debt obligations are issued in maturities of four, 13 and 26 weeks in various denominations as low as $1,000. Learn how to buy US Treasury bonds and T-bills online through TreasuryDirect.

Treasury Bills (T-Bills) - Meaning, Examples, Calculations For example, The US Federal Treasury Department issued 52week T-Bills at a discounted rate of $97 per bill at face value of $100. An investor purchases 10 T-Bills at a competitive bid price of $97 per bill and invests a total of $970. After 52 weeks, the T bills matured.

Treasury Coupon Issues | U.S. Department of the Treasury Daily Treasury Bill Rates. ... "The Yield Curve for Treasury Nominal Coupon Issues" by James A. Girola - 5/16/2014 "The Treasury Real Yield Curve and Breakeven Inflation" by James A. Girola - 7/21/2015 "Treasury Yield Curves and Discount Rates" by James A. Girola - 2/27/2016

T-bills: Information for Individuals What It Is Good For. Use T-bills to: Diversify your investment portfolio. Receive a fixed interest payment at maturity. Invest in a safe, short-term investment option. The price of SGS T-bills may rise or fall before maturity. If you want the flexibility of getting your full investment back in any given month, consider Singapore Savings Bonds ...

US T-Bill Calculator | Good Calculators Treasury Bills are normally sold in groups of $1000 with a standard period of either 4 weeks, 13 weeks, or 26 weeks. Using our US T-Bill Calculator below you are able to select the face value of your bonds using the drop down list of common values, or you may enter an alternative value that isn't listed in the "Other Value" box.

Treasury Yield Definition - Investopedia The yield on a 10-year note with 3% coupon purchased at a premium for $10,300 and held to maturity is: Treasury Yield = [$300 + ( ($10,000 - $10,300) / 10)] ÷ [ ($10,000 + $10,300) / 2] = $270 /...

US Treasury Bonds - Fidelity The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity.

Treasury Bills - Guide to Understanding How T-Bills Work The difference between the face value of the T-bill and the amount that an investor pays is called the discount rate, which is calculated as a percentage. In this case, the discount rate is 5% of the face value. Get T-Bill rates directly from the US Treasury website. How to Purchase Treasury Bills

Post a Comment for "39 t bill coupon rate"