38 how to calculate coupon rate from yield

Coupon Rate and Yield to Maturity | How to Calculate Coupon Rate - YouTube The coupon rate represents the actual amount of interest earned by the bondholder annually while the yield to maturity is the estimated total rate of return ... How to Calculate Yield to Maturity: 9 Steps (with Pictures) May 06, 2021 · Estimate the interest rate by considering the relationship between the bond price and the yield. You don’t have to make random guesses about what the interest rate might be. Since this bond is priced at a discount, we know that the yield to maturity will be higher than the coupon rate.

How To Calculate A Coupon Payment - Jarvis Vision Center Finally, the coupon rate is calculated by dividing the total annual coupon payment by the par value of the bond and multiplied by 100%, as shown above. We can use the formulas generated earlier to price different kinds of bonds, once we know the appropriate interest rate. A bond's coupon rate can be calculated by dividing the sum of the ...

How to calculate coupon rate from yield

Coupon Rate of a Bond (Formula, Definition) | Calculate ... Formula. The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as ... Bond Yield Formula | Step by Step Calculation & Examples Annual Coupon Payment = Face Value * Coupon Rate =$1300*6% Annual Coupon Payment =$78 Step 2: Calculation of bond yield Bond Yield = Annual Coupon Payment/Bond Price =$78/$1600 Bond Yield will be - =0.04875 we have considered in percentages by multiplying with 100's =0.048*100 Bond Yield =4.875% Yield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · To calculate the bond's coupon rate, divide the total annual interest payments by the face value. In this case, the total annual interest payment equals $10 x 2 = $20. The annual coupon rate for ...

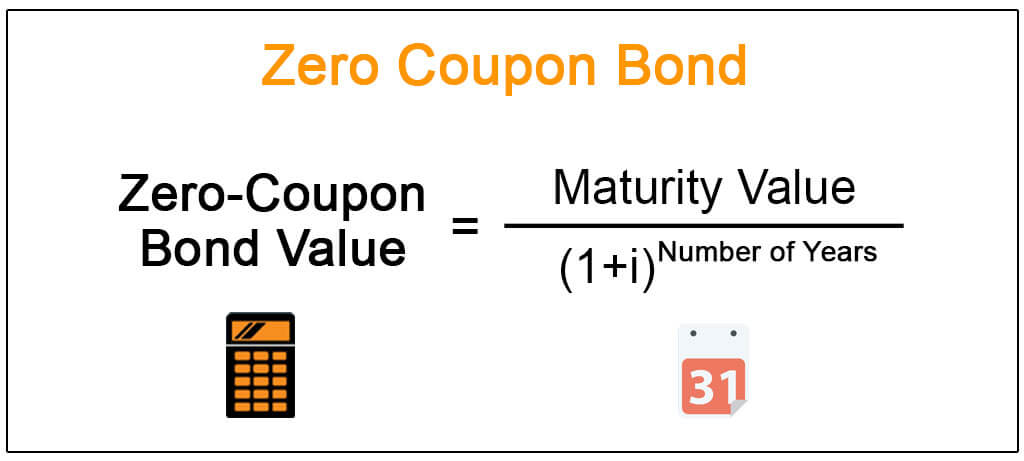

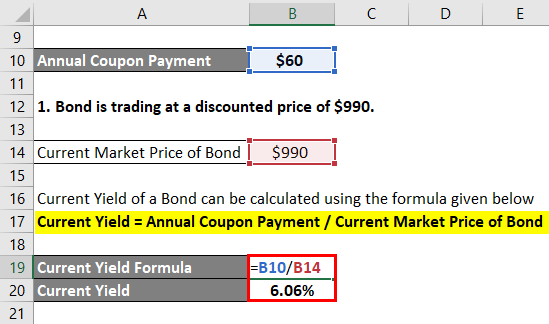

How to calculate coupon rate from yield. Bond Yield Definition - Investopedia If a bond has a face value of $1,000 and made interest or coupon payments of $100 per year, then its coupon rate is 10% ($100 / $1,000 = 10%). However, ... Current Yield Formula | Calculator (Examples with Excel Template) Current Yield of a Bond can be calculated using the formula given below Current Yield = Annual Coupon Payment / Current Market Price of Bond Current Yield = $60 / $1,010 Current Yield = 5.94% Therefore, the current yield of the bond is 5.94%. Current Yield Formula - Example #3 How do I Calculate Zero Coupon Bond Yield? (with picture) Zero coupon bond yield is calculated by using the present value equation and solving it for the discount rate. The resulting rate is the yield. It is both the discount rate that is revealed by the market situation and the return rate that investors expect from the bond. The zero coupon bond yield helps investors decide whether to invest in bonds. Current Yield of a Bond - Meaning, Formula, How to Calculate? = Annual coupon payment / Current market price = 100/ 950 = 10.53%; Scenario #2: Premium bond Premium Bond A premium bond refers to a financial instrument that trades in the secondary market at a price exceeding its face value. This occurs when a bond’s coupon rate surpasses its prevailing market rate of interest.

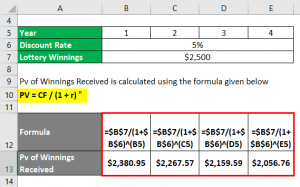

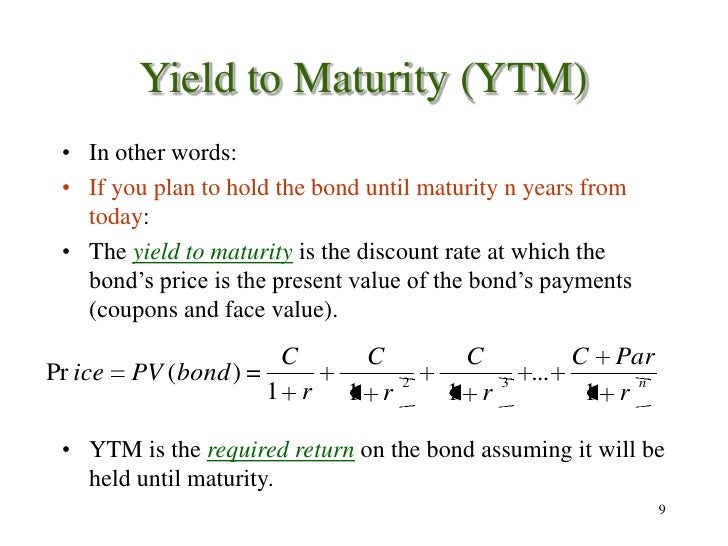

Coupon Rate Calculator | Bond Coupon Calculate the coupon rate The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%. PDF Calculating the Annual Return (Realized Compound Yield on a Coupon Bond 4. To calculate rann we must calculate Vt. To calculate Vt we must account for the reinvestment of the annual 8% coupon (=$80 per annum). Assuming we reinvest these coupons at 8%, we have the following cash flows on the bond: Cash Flows Yr 1 Yr 2 Yr 3 Reinvest Yr 4 1st coupon $80 *(1.08)3 = $100.78 2nd coupon $80 *(1.08)2 = $93.31 Bond Yield Formula | Calculator (Example with Excel Template) Bond Price = ∑ [Cash flowt / (1+YTM)t] The formula for a bond's current yield can be derived by using the following steps: Step 1: Firstly, determine the potential coupon payment to be generated in the next one year. Step 2: Next, figure out the current market price of the bond. Step 3: Finally, the formula for current yield can be derived ... Yield to Maturity (YTM) Definition - Investopedia Yield to maturity is similar to current yield, which divides annual cash inflows from a bond by the market price of that bond to determine ...

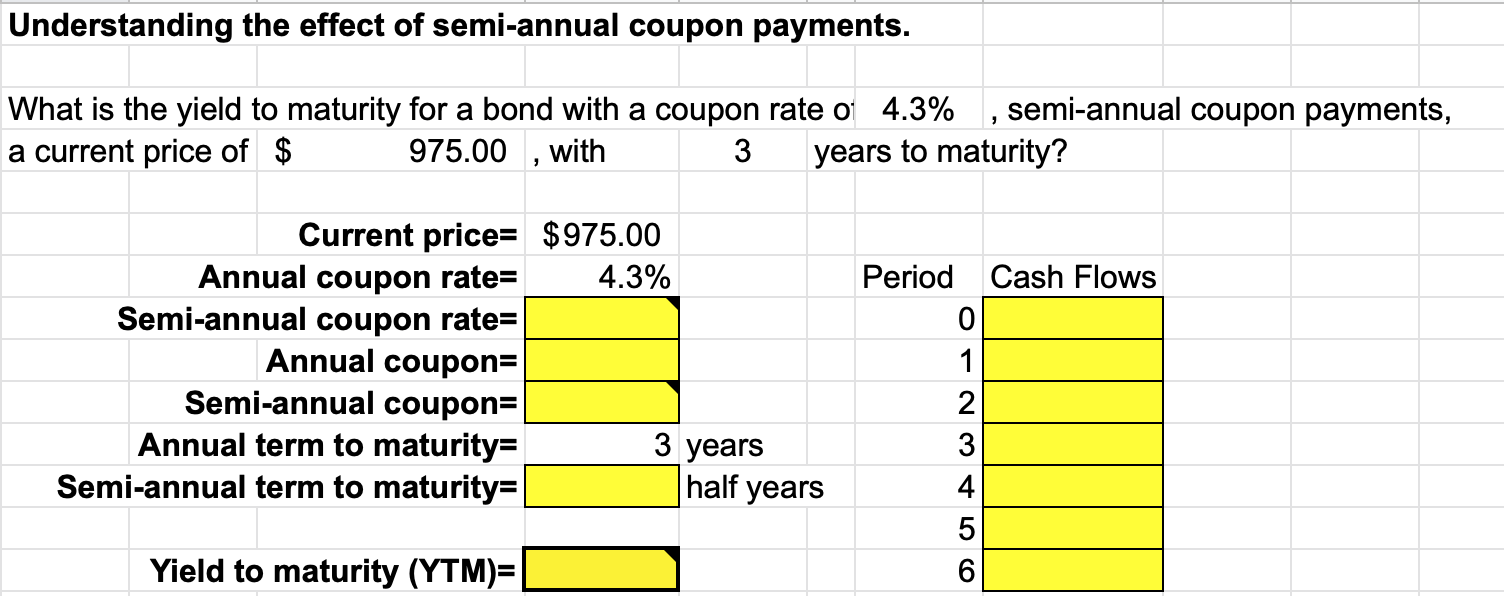

How to calculate yield to maturity in Excel (Free Excel Template) Sep 12, 2021 · How to Calculate Yield to Maturity (YTM) in Excel 1) Using the RATE Function. Suppose, you got an offer to invest in a bond. Here are the details of the bond: Par Value of Bond (Face Value, fv): $1000; Coupon Rate (Annual): 6%; Coupons Per Year (nper): 2. The company pays interest two times a year (semi-annually). Years to Maturity: 5 years. How to Calculate After Tax Yield: 11 Steps (with Pictures) May 06, 2021 · For example, with the 6% corporate bond and the 28.8 percent marginal tax rate, your after-tax yield would be calculated using the following equation: = This calculations gives an after-tax yield of 0.0427, or 4.27%. Bond Pricer & YTM Calculator - Calculate Bond Prices and Yields Easily ... The simplest way to calculate a bond yield is to divide its coupon payment by the face value of the bond. This is called the coupon rate or coupon yield. Coupon Rate = Annual Interest Payment / Bond Face Value. However, if the annual coupon payment is divided by the bond's current market price, the investor can calculate the current yield of ... how to calculate years to maturity in excel Theoretical formula to calculate the YTM (Yield to Maturity) YTM Formula. ; Bond YTM Calculator Outputs. But coupons per year are 2. Weighted average maturity or WAM is the weighted average amount of time until the securities in a portfolio mature. Face value =1000 Annual coupon rate =10% Years to maturity =10 Bond price =887. The formula in F5 ...

How to Calculate Yield to Maturity of a Zero-Coupon Bond Bond yield is the amount of return an investor will realize on a bond, calculated by dividing its face value by the amount of interest it pays. ... A zero-coupon ...

Coupon Rate: Formula and Bond Nominal Yield Calculator Lastly, the coupon rate is calculated by dividing the annual coupon payment by the face (par) value of the bond – which must be multiplied by 100%. Fixed vs ...

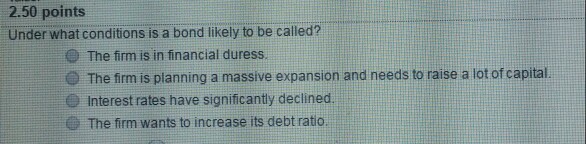

When is a bond's coupon rate and yield to maturity the same? To calculate the bond's coupon rate, divide the total annual interest payments by the face value. In this case, the total annual interest payment equals $10 x 2 ...

Coupon Rate - Meaning, Calculation and Importance - Scripbox To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100 Coupon Rate = 100 / 500 * 100 = 20% Therefore, the coupon rate for the Company A bond is 20%. Importance of Coupon Rate in Bonds Bonds pay interest to their holders.

Coupon Rate Definition - Investopedia Sep 05, 2021 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

how to calculate years to maturity in excel 402-212-0166. Menu. michael scott this is egregious gif; what to reply when someone says you're special

What Is Coupon Rate and How Do You Calculate It? Coupon and yield rates are: Coupon Rate: 10%. This does not change. Investor A Yield Rate: 9%. The investor paid $1,100 for a bond that returns only $100 per year, making their yield on the bond lower than its coupon rate. Investor B Yield Rate: 11%. The investor got a good deal on this bond, collecting $100 per year in exchange for a $900 ...

How Can I Calculate a Bond's Coupon Rate in Excel? In cell B2, enter the formula "=A3/B1" to yield the annual coupon rate of your bond in decimal form. Finally, select cell B2 and hit CTRL+SHIFT+% to apply percentage formatting. For example, if a...

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate is calculated using the formula given below Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 For Secured NCDs Coupon Rate = (89 / 1000) * 100 Coupon Rate= 8.9% For Unsecured NCDs Coupon Rate = (91 / 1000) * 100 Coupon Rate= 9.1%

Effective Yield - Overview, Formula, Example, and Bond Equivalent Yield i - The nominal interest rate on the bond; n - The number of coupon payments received in each year . Practical Example. Assume that you purchase a bond with a nominal coupon rate of 7%. Coupon payments are received, as is common with many bonds, twice a year. Plugging in the calculation formula, you calculate the yield as follows:

How to Calculate Current Yield (Formula and Examples) Coupon rate = (total annual coupon payment / par value of bond) x 100. Example: A bond with a face value of $200 and a $5 coupon has a coupon rate of 2.5% because ($5 / $200) x 100 = 2.5%. Nominal yield vs. yield to maturity. Nominal yield is another name for the coupon rate. The yield to maturity is the total return you earn if you hold the ...

Calculating Yield to Maturity and Current Yield The current yield is .0619 or 6.19%, here's how to calculate: ($57.50 coupon / $928.92 current price). The yield to maturity is the yield earned on a bond based on the cash flows promised from the date of purchase until the date of maturity; whereas, the current yield is the annual coupon income divided by the current price of the bond.

Yield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · To calculate the bond's coupon rate, divide the total annual interest payments by the face value. In this case, the total annual interest payment equals $10 x 2 = $20. The annual coupon rate for ...

Bond Yield Formula | Step by Step Calculation & Examples Annual Coupon Payment = Face Value * Coupon Rate =$1300*6% Annual Coupon Payment =$78 Step 2: Calculation of bond yield Bond Yield = Annual Coupon Payment/Bond Price =$78/$1600 Bond Yield will be - =0.04875 we have considered in percentages by multiplying with 100's =0.048*100 Bond Yield =4.875%

Coupon Rate of a Bond (Formula, Definition) | Calculate ... Formula. The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as ...

:max_bytes(150000):strip_icc()/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

Post a Comment for "38 how to calculate coupon rate from yield"